Rural Insight -

Rural Insight pastoral market sector report H1 2024

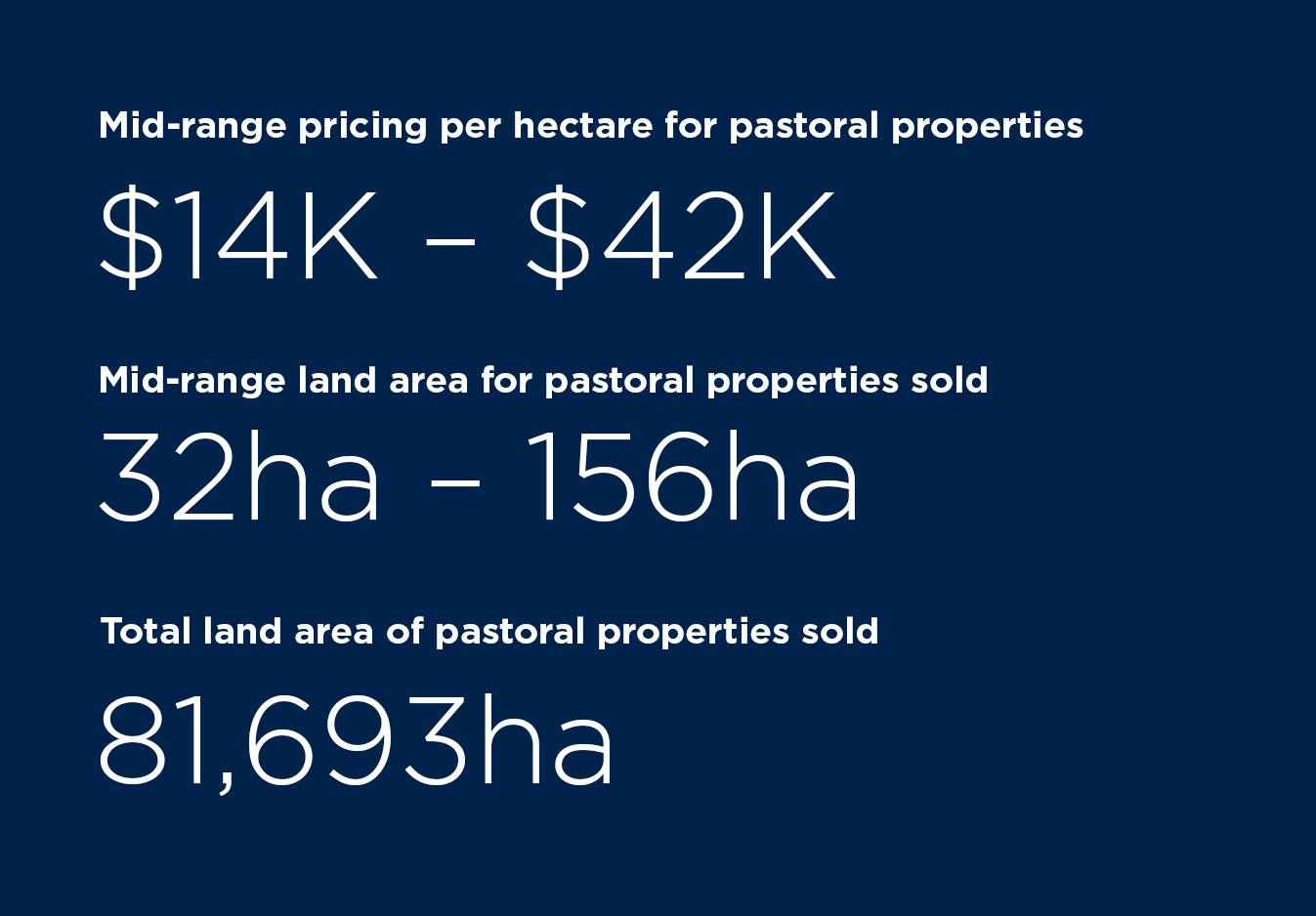

See below for a summary of the biggest trends in the pastoral market, plus an outlook on the next 12 months.

Biggest trends

Margin compression slows activity

Margins on farm continue to be compressed with red meat commodity prices coming off their peak and now sitting at or below 5 year average export value. Together with accretive costs incurred on farm, margins are thin influencing overall affordability and activity.

Environmental requirements add due diligence

Pastoral buyers remain alert to changing environmental requirements and considerations, given past regulatory uncertainty. While more acute in the dairy sector, vendors should have quality documentation available to assist saleability, particularly for the higher value properties that may attract more scrutiny.

Intensity of competing land use has reduced

Competing land use amongst the sub-sectors remains, but at lower levels of intensity. Dairy farmers continue to seek support land as part of their strategy to meet environmental standards, and reduced competition from fattening operators given thinner margins. Volatility in NZU carbon price and regulatory settings continue to constrain conversion of hill country to forestry.

Outlook for the next 12 months

Unravelling of regulation to provide some clarity

The direction provided from central government that it will halt and review certain regulatory compliance requirements impacting rural landowners should mean there is more clarity going forward. As a result, it is expected there will be more confidence in the pastoral sector.

Thinner buyer pool with increased options

Buyer willingness will continue to be heavily influenced by their capacity and affordability assessment. Market activity is therefore expected to continue to be associated with better quality properties, strategic acquisitions or where there is a perceived value gain as a result of more immediate motivating factors of vendors (such as age, energy, debt or up/downsize plans).

Ability to capitalise on opportunities will be tested

The reduction in competing land use (particularly from forestry) will continue to provide opportunity for buyers of hill country for breeding after having been arguably priced out of this market in more recent times. Those with an ability to see through the thinner margins of the current season(s) will be able to capitalise on options in the market.